Trade for you! Trade for your account!

Invest for you! Invest for your account!

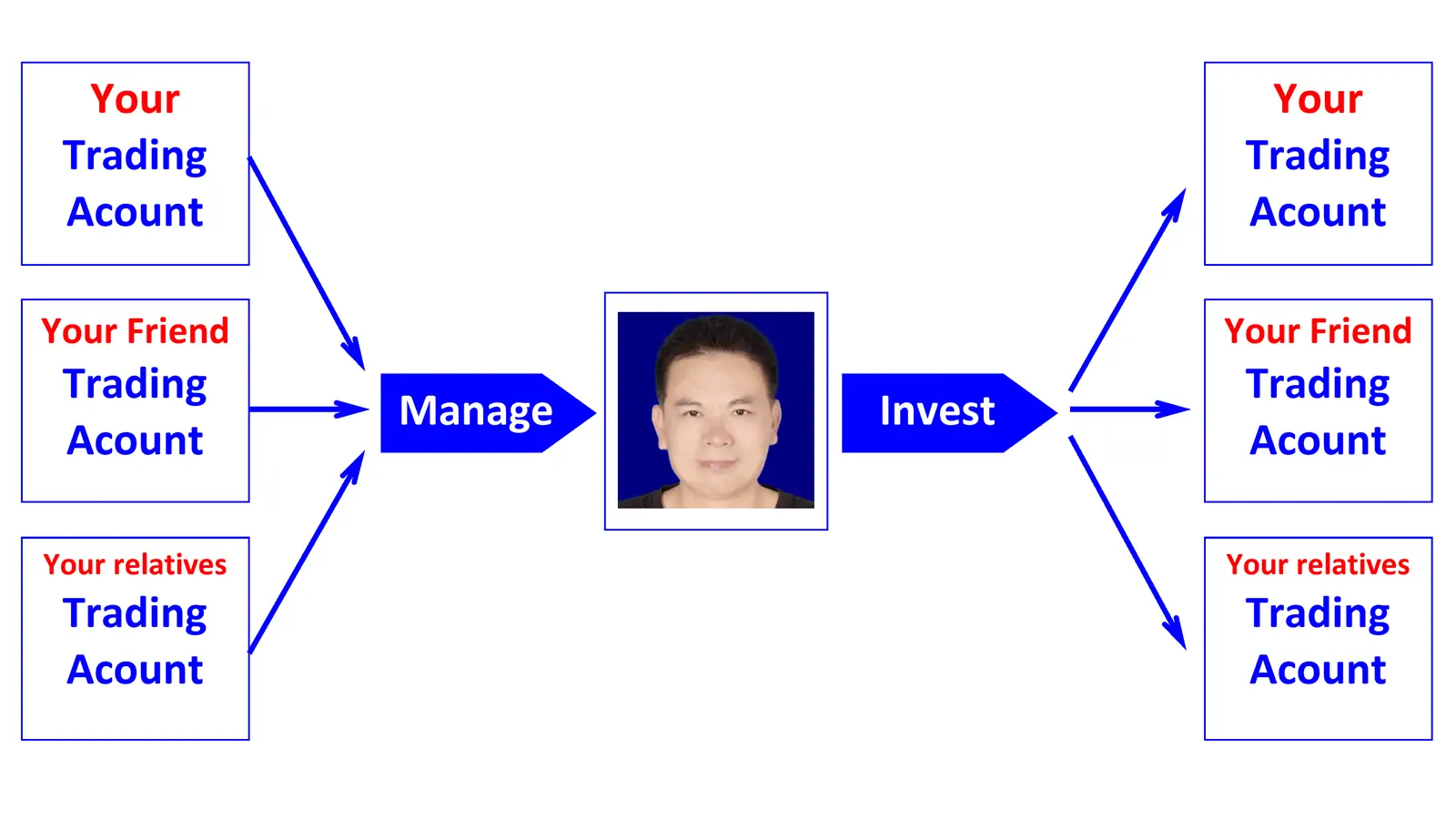

Direct | Joint | MAM | PAMM | LAMM | POA

Forex prop firm | Asset management company | Personal large funds.

Formal starting from $500,000, test starting from $50,000.

Profits are shared by half (50%), and losses are shared by a quarter (25%).

Forex multi-account manager Z-X-N

Accepts global forex account operation, investment, and trading

Assists family office investment and autonomous management

Foreign exchange investment manager Z-X-N accepts entrusted investment and trading for global foreign exchange investment accounts.

I am Z-X-N. Since 2000, I have been running a foreign trade manufacturing factory in Guangzhou, with products sold globally. Factory website: www.gosdar.com. In 2006, due to significant losses from entrusting investment business to international banks, I embarked on a self-taught journey in investment trading. After ten years of in-depth research, I now focus on foreign exchange trading and long-term investment business in London, Switzerland, Hong Kong, and other regions.

I possess core expertise in English application and web programming. During my early years running a factory, I successfully expanded overseas business through an online marketing system. After entering the investment field, I fully utilized my programming skills to complete comprehensive testing of various indicators for the MT4 trading system. Simultaneously, I conducted in-depth research by searching the official websites of major global banks and various professional materials in the foreign exchange field. Practical experience has proven that the only technical indicators with real-world application value are moving averages and candlestick charts. Effective trading methods focus on four core patterns: breakout buying, breakout selling, pullback buying, and pullback selling.

Based on nearly twenty years of practical experience in foreign exchange investment, I have summarized three core long-term strategies: First, when there are significant interest rate differentials between currencies, I employ a carry trade strategy; second, when currency prices are at historical highs or lows, I use large positions to buy at the top or bottom; third, when facing market volatility caused by currency crises or news speculation, I follow the principle of contrarian investing and enter the market in the opposite direction, achieving significant returns through swing trading or long-term holding.

Foreign exchange investment has significant advantages, primarily because if high leverage is strictly controlled or avoided, even if there are temporary misjudgments, significant losses are usually avoided. This is because currency prices tend to revert to their intrinsic value in the long run, allowing for the gradual recovery of temporary losses, and most global currencies possess this intrinsic value-reversion attribute.

Foreign Exchange Manager | Z-X-N | Detailed Introduction.

Starting in 1993, I leveraged my English proficiency to begin my career in Guangzhou. In 2000, utilizing my core strengths in English, website building, and online marketing, I founded a manufacturing company and began cross-border export business, with products sold globally.

In 2007, based on my substantial foreign exchange holdings, I shifted my career focus to the financial investment field, officially initiating systematic learning, in-depth research, and small-scale pilot trading in foreign exchange investment. In 2008, leveraging the resource advantages of the international financial market, I conducted large-scale, high-volume foreign exchange investment and trading business through financial institutions and foreign exchange banks in the UK, Switzerland, and Hong Kong.

In 2015, based on eight years of accumulated practical experience in foreign exchange investment, I officially launched a client foreign exchange account management, investment, and trading service, with a minimum account balance of US$500,000. For cautious and conservative clients, a trial investment account service is offered to facilitate their verification of my trading capabilities. The minimum investment for this type of account is $50,000.

Service Principles: I only provide agency management, investment, and trading services for clients' trading accounts; I do not directly hold client funds. Joint trading account partnerships are preferred.

Why did foreign exchange manager Z-X-N enter the field of foreign exchange investment?

My initial foray into financial investment stemmed from an urgent need to effectively allocate and preserve the value of idle foreign exchange funds. In 2000, I founded an export manufacturing company in Guangzhou, whose main products were marketed in Europe and the United States, and the business continued to grow steadily. However, due to China's then-current annual foreign exchange settlement quota of US$50,000 for individuals and enterprises, a large amount of US dollar funds accumulated in the company's account that could not be promptly repatriated.

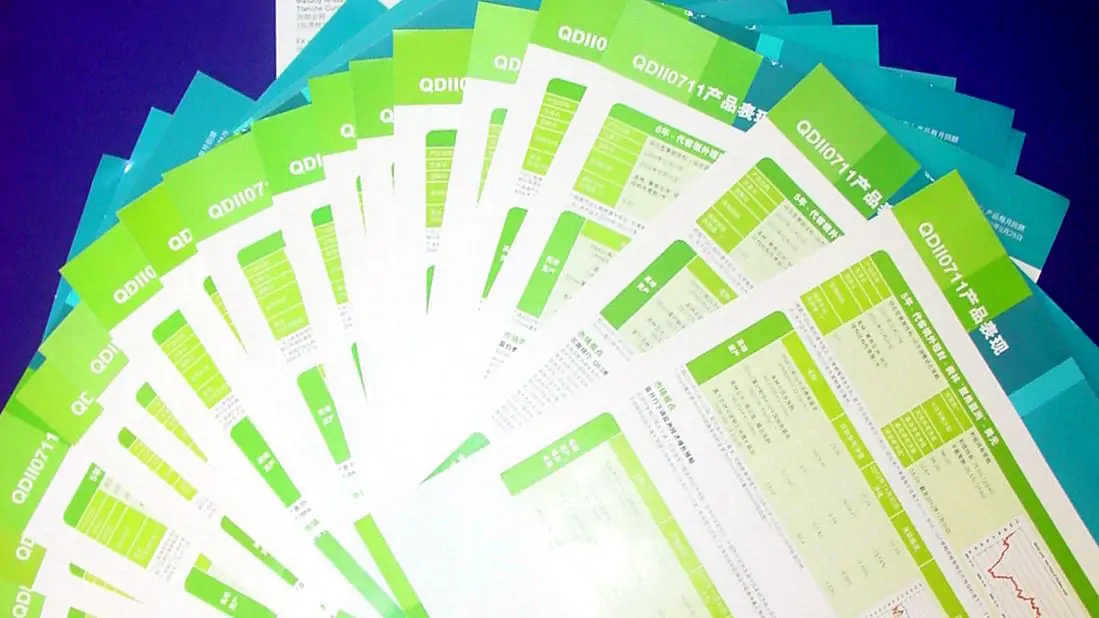

To revitalize these hard-earned assets, around 2006, I entrusted some funds to a well-known international bank for wealth management. Unfortunately, the investment results were far below expectations—several structured products suffered serious losses, especially product number QDII0711 (i.e., "Merrill Lynch Focus Asia Structured Investment No. 2 Wealth Management Plan"), which ultimately lost nearly 70%, becoming a key turning point for me to switch to independent investment.

In 2008, as the Chinese government further strengthened its regulation of cross-border capital flows, a large amount of export revenue became stuck in the overseas banking system, unable to be smoothly repatriated. Faced with the reality of millions of dollars being tied up in overseas accounts for an extended period, I was forced to shift from passive wealth management to active management, and began systematically engaging in long-term foreign exchange investment. My investment cycle is typically three to five years, focusing on fundamental drivers and macroeconomic trend judgments, rather than short-term high-frequency or scalping trading.

This fund pool not only includes my personal capital but also integrates the overseas assets of several partners engaged in export trade who also faced the problem of capital being tied up. Based on this, I also actively seek cooperation with external investors who have a long-term vision and matching risk appetite. It is important to note that I do not directly hold or manage client funds, but rather provide professional account management, strategy execution, and asset operation services by authorizing the operation of clients' trading accounts, committed to helping clients achieve steady wealth growth under strict risk control.

Foreign Exchange Manager Z-X-N's Diversified Investment Strategy System.

I. Currency Hedging Strategy: Focusing on substantial currency exchange transactions, with long-term stable returns as the core objective. This strategy uses currency swaps as the core operational vehicle, constructing a long-term investment portfolio to achieve continuous and stable returns.

II. Carry Trade Strategy: Targeting significant interest rate differences between different currency pairs, this strategy implements arbitrage operations to maximize returns. The core of the strategy lies in fully exploring and realizing the continuous profit potential brought by interest rate differentials by holding the underlying currency pair for the long term.

III. Long Terms Extremes-Based Positioning Strategy: Based on historical currency price fluctuation cycles, this strategy implements large-scale capital intervention to buy at the top or bottom when prices reach historical extreme ranges (highs or lows). By holding positions long-term and waiting for prices to return to a reasonable range or for a trend to unfold, excess returns can be realized.

IV. Crisis & News-Driven Contrarian Strategy: This strategy employs a contrarian investment framework to address extreme market conditions such as currency crises and excessive speculation in the foreign exchange market. It encompasses diverse operational models including contrarian trading strategies, trend following, and long-term position holding, leveraging the amplified profit window of market volatility to achieve significant differentiated returns.

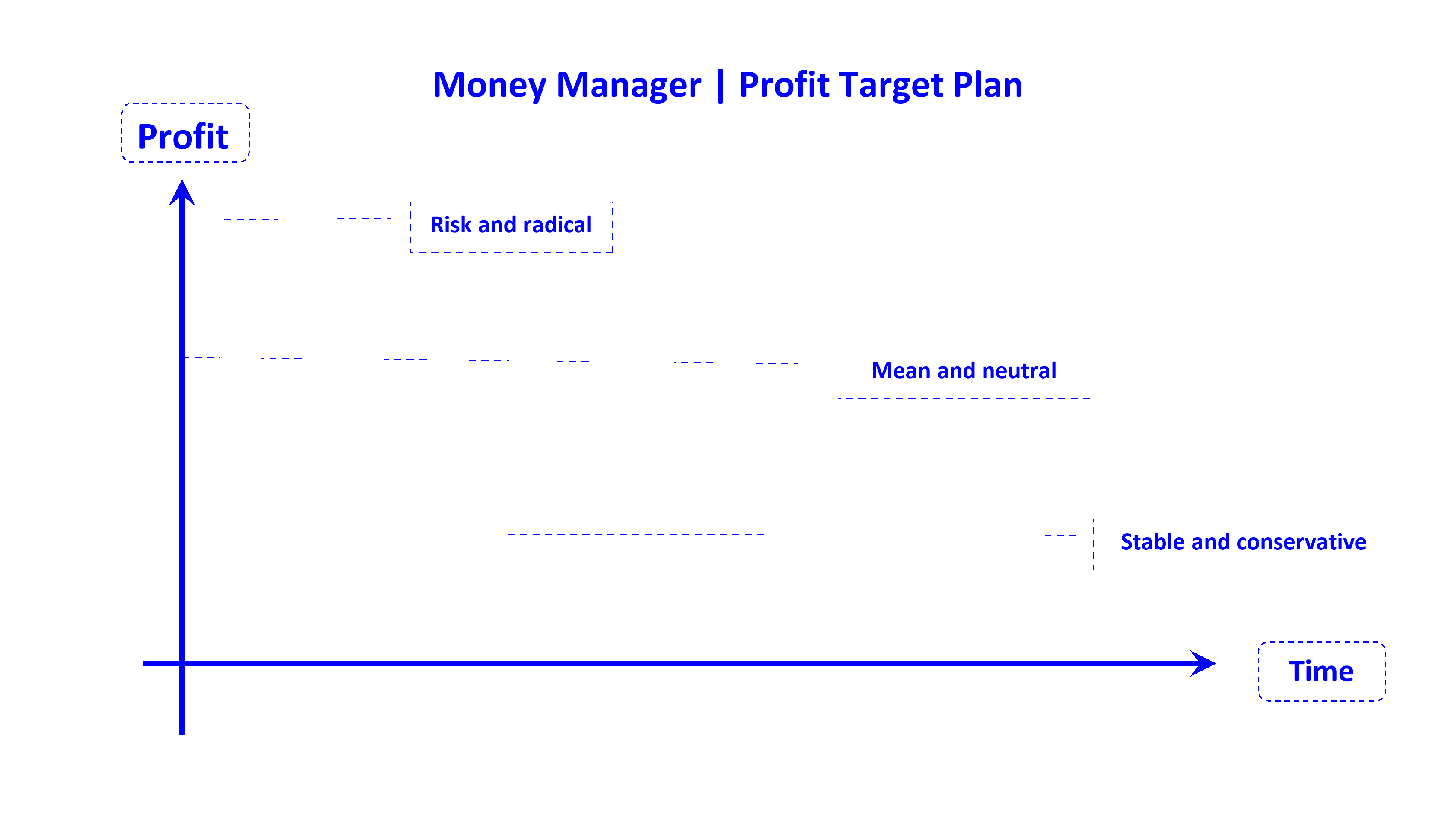

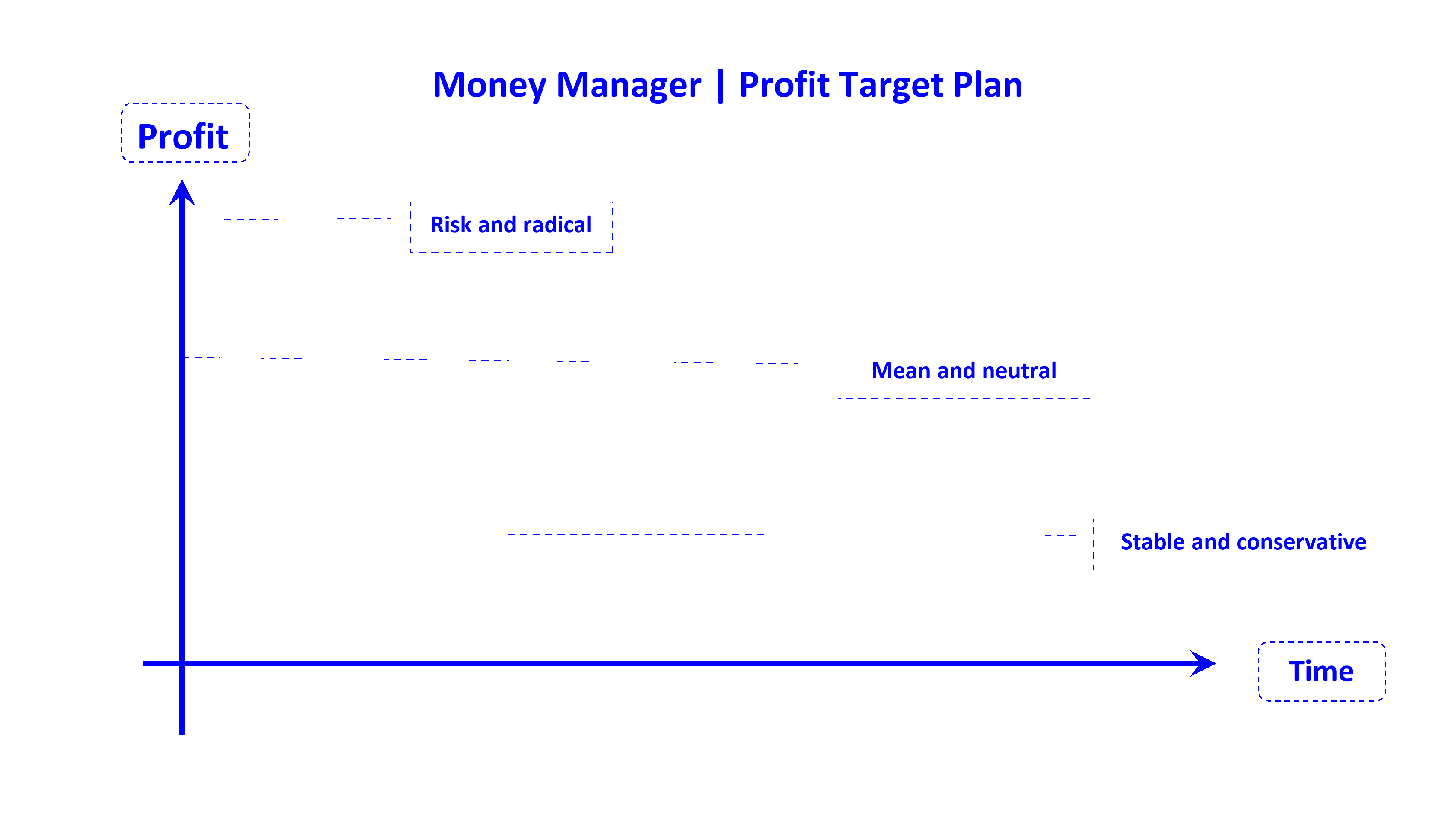

Profit and Loss Plan Explanation for Forex Manager Z-X-N

I. Profit and Loss Distribution Mechanism.

1. Profit Distribution: The forex manager is entitled to 50% of the profits. This distribution ratio is a reasonable return on the manager's professional competence and market timing ability.

2. Loss Sharing: The forex manager is responsible for 25% of the losses. This clause aims to strengthen the manager's decision-making prudence, restrain aggressive trading behavior, and reduce the risk of excessive losses.

II. Fee Collection Rules.

The forex manager only charges a performance fee and does not charge additional management fees or trading commissions. Performance Fee Calculation Rules: After deducting the current period's profit from the previous period's loss, the performance fee is calculated based on the actual profit. Example: If the first period has a 5% loss and the second period has a 25% profit, then the difference between the current period's profit and the previous period's loss (25% - 5% = 20%) will be used as the calculation base, from which the forex manager will collect the performance fee.

III. Trading Objectives and Profit Determination Method.

1. Trading Objectives: The forex manager's core trading objective is to achieve a conservative return rate, adhering to the principle of prudent trading and not pursuing short-term windfall profits.

2. Profit Determination: The final profit amount is determined comprehensively based on the market fluctuations and actual trading results for the year.

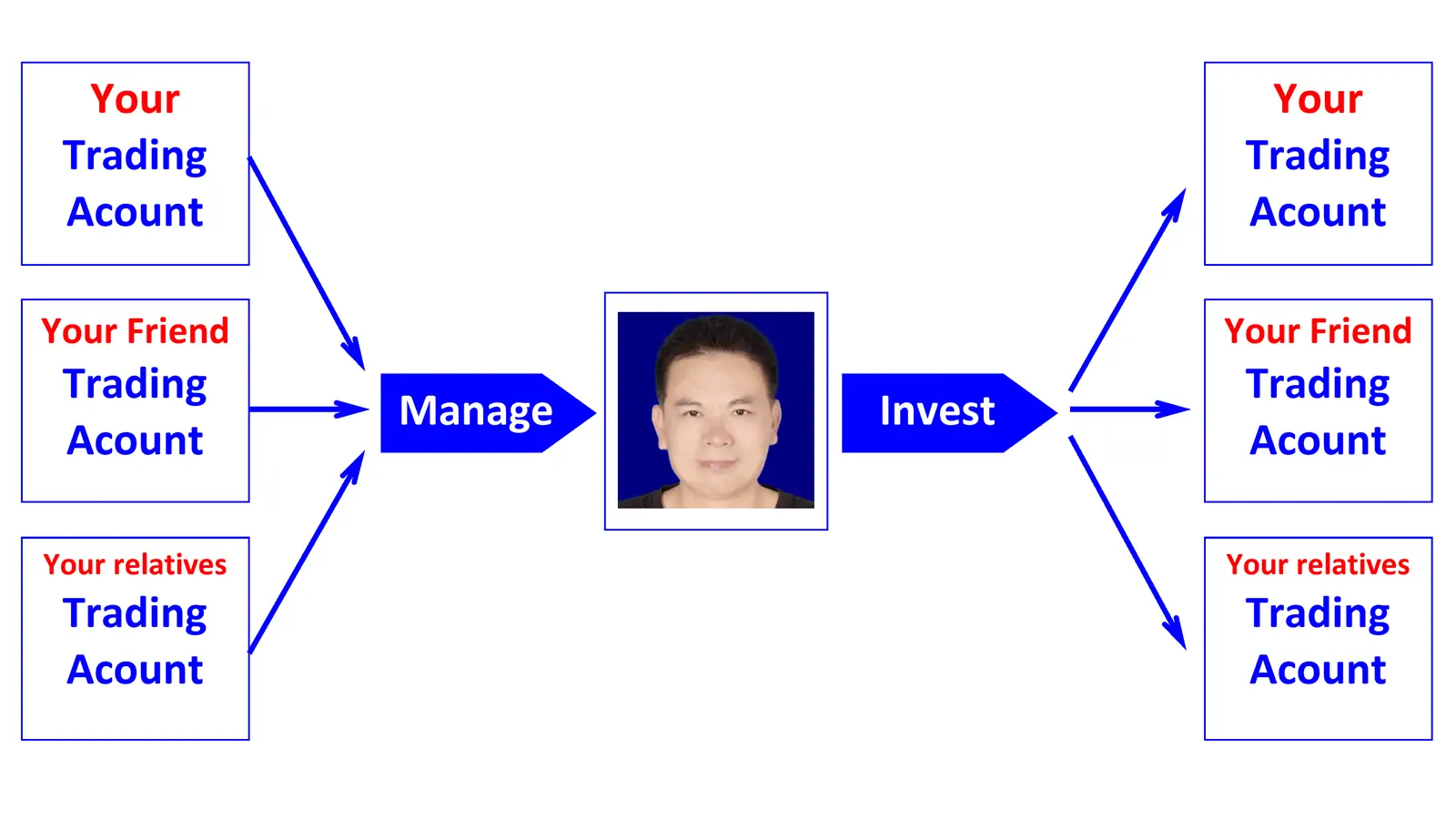

Forex Manager Z-X-N provides you with professional forex investment and trading services directly!

You directly provide your investment and trading account username and password, establishing a private direct entrustment relationship. This relationship is based on mutual trust.

Service Cooperation Model Description: After you provide your account information, I will directly conduct trading operations on your behalf. Profits will be split 50/50. If losses occur, I will bear 25% of the loss. Furthermore, you can choose or negotiate other cooperation agreement terms that conform to the principle of mutual benefit; the final decision on cooperation details rests with you.

Risk Protection Warning: Under this service model, we do not hold any of your funds; we only conduct trading operations through the account you provide, thus fundamentally avoiding the risk of fund security.

Joint Investment Trading Account Cooperation Model: You provide the funds, and I am responsible for the execution of trades, achieving professional division of labor, shared risk, and shared profits.

In this cooperation, both parties jointly open a joint trading account: you, as the investor, provide the operating capital, and I, as the trading manager, am responsible for professional investment operations. This model represents a mutually beneficial cooperative relationship established between natural persons based on full trust.

Account profit and risk arrangements are as follows: For profits, I will receive 50% as performance compensation; for losses, I will bear 25% of the losses. Specific cooperation terms can be negotiated and drafted according to your needs, and the final plan respects your decision.

During the cooperation period, all funds remain in the joint account. I only execute trading instructions and do not hold or safeguard funds, thereby completely avoiding the risk of fund security. We look forward to establishing a long-term, stable, and mutually trusting professional cooperation with you through this model.

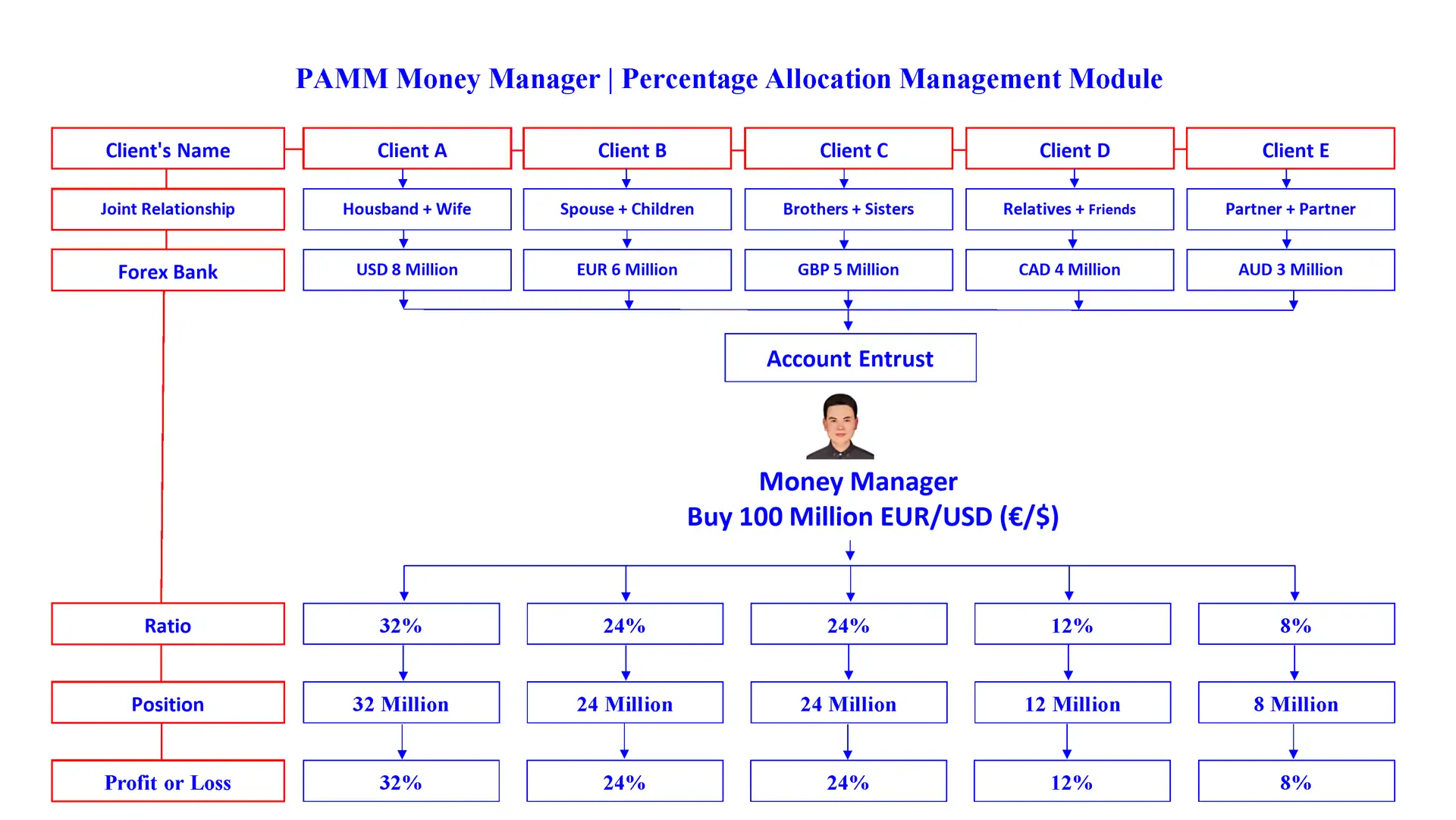

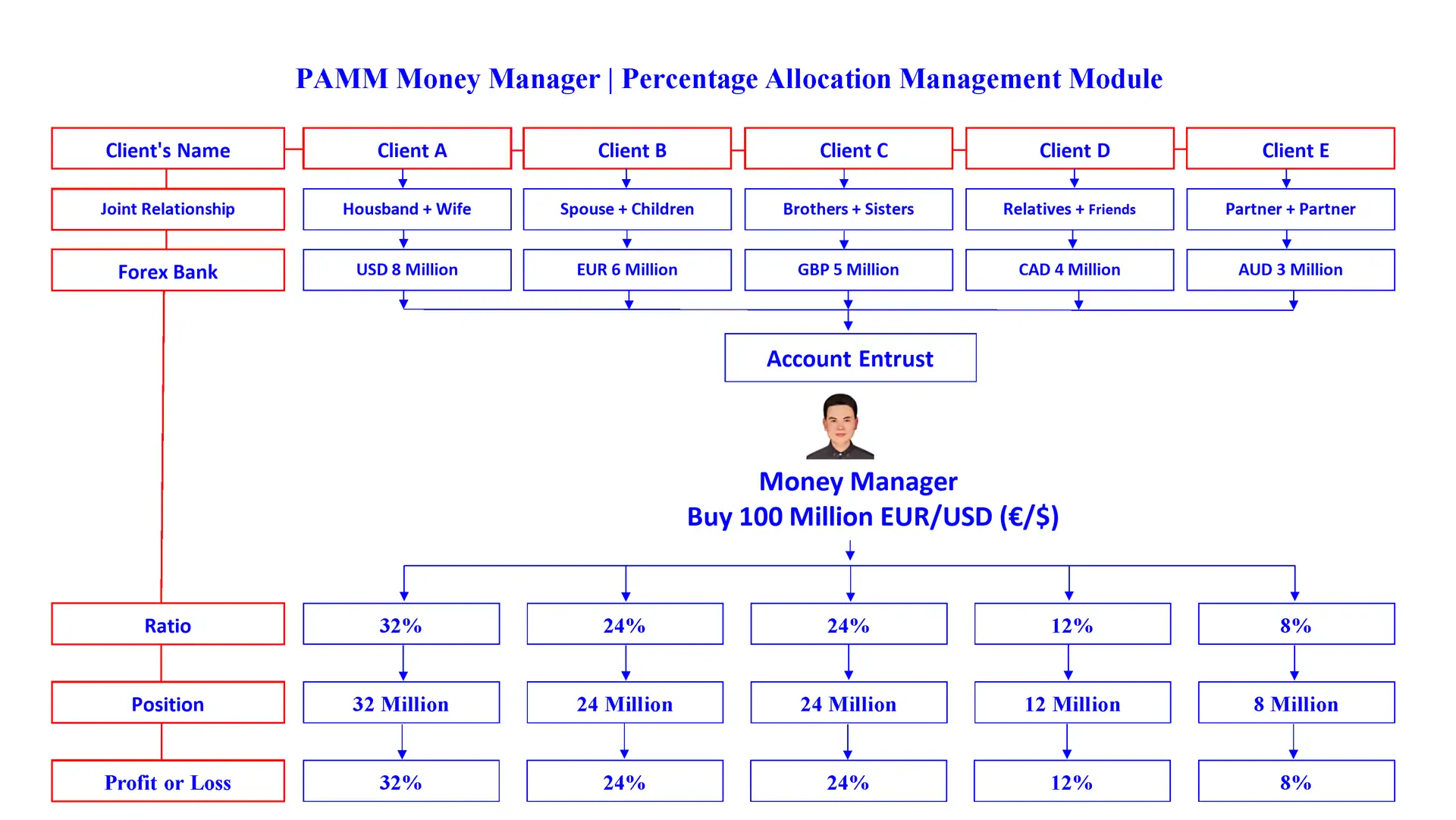

MAM, PAMM, LAMM, POA, and other account management models primarily provide professional investment and trading services for client accounts.

MAM (Multi-Account Management), PAMM (Percentage Allocation Management), LAMM (Lot Allocation Management), and POA (Power of Attorney) are all widely supported account management structures by major international forex brokers. These models allow clients to authorize professional traders to execute investment decisions on their behalf while retaining ownership of their funds. This is a mature, transparent, and regulated form of asset management.

If you entrust your account to us for investment and trading operations, the relevant cooperation terms are as follows: Profits will be split 50/50 between both parties, and this split will be included in the formal entrustment agreement issued by the forex broker. In the event of trading losses, we will bear 25% of the loss liability. This loss liability clause is beyond the scope of a standard brokerage entrustment agreement and must be clarified in a separate private cooperation agreement signed by both parties.

During this cooperation, we are only responsible for account transaction operations and will not access your account funds. This cooperation model has eliminated fund security risks from its operational mechanism.

Introduction to Account Custody Models such as MAM, PAMM, LAMM, and POA.

Clients need to entrust a forex manager to manage their trading accounts using custody models such as MAM, PAMM, LAMM, and POA. After the entrustment takes effect, the client's account will be officially included in the management system of the corresponding custody model.

Clients included in the MAM, PAMM, LAMM, and POA custody models can only log in to their account's read-only portal and have no right to execute any trading operations. The account's trading decision-making power is exercised uniformly by the entrusted forex manager.

The entrusted client has the right to terminate the account custody at any time and can withdraw their account from the MAM, PAMM, LAMM, and POA custody system managed by the forex manager. After the account withdrawal is completed, the client will regain full operational rights to their own account and can independently carry out trading-related operations.

We can undertake family fund management services through account custody models such as MAM, PAMM, LAMM, and POA.

If you intend to preserve and grow your family funds through forex investment, you must first select a trustworthy broker with compliant qualifications and open a personal trading account. After the account is opened, you can sign an agency trading agreement with us through the broker, entrusting us to conduct professional trading operations on your account; profit distribution will be automatically cleared and transferred by the trading platform system you selected.

Regarding fund security, the core logic is as follows: We only have trading operation rights for your trading account and do not directly control the account funds; at the same time, we give priority to accepting joint accounts. According to the general rules of the forex banking and brokerage industry, fund transfers are limited to the account holder and are strictly prohibited from being transferred to third parties. This rule is fundamentally different from the transfer regulations of ordinary commercial banks, ensuring fund security from a systemic perspective.

Our custody services cover all models: MAM, PAMM, LAMM, and POA. There are no restrictions on the source of custody accounts; any compliant trading platform that supports the above custody models can be seamlessly integrated for management.

Regarding the initial capital size of custody accounts, we recommend the following: Trial investment should start at no less than US$50,000; formal investment should start at no less than US$500,000.

Note: Joint accounts refer to trading accounts jointly held and owned by you and your spouse, children, relatives, etc. The core advantage of this type of account is that in the event of unforeseen circumstances, any account holder can legally and compliantly exercise their right to transfer funds, ensuring the safety and controllability of account rights.

Appendix: Over Two Decades of Practical Experience | Tens of Thousands of Original Research Articles Available for Reference.

Since shifting from foreign trade manufacturing to foreign exchange investment in 2007, I have gained a deep understanding of the operating essence of the foreign exchange market and the core logic of long-term investment through over a decade of intensive self-study, massive real-world verification, and systematic review.

Now, I am publishing tens of thousands of original research articles accumulated over more than two decades, fully presenting my decision-making logic, position management, and execution discipline under various market environments, allowing clients to objectively assess the robustness of my strategies and the consistency of long-term performance.

This knowledge base also provides a high-value learning path for beginners, helping them avoid common pitfalls, shorten trial-and-error cycles, and build rational and sustainable trading capabilities.

In the forex market, long-term traders often fall into a conservative trading pattern, making the entire trading process seem tedious and monotonous. This feeling doesn't appear in the short term but gradually becomes more pronounced with extended trading cycles.

When a trader's trading system and operating rules become rigid, adhering to a single trading model without flexible adjustments, this sense of boredom intensifies. In fact, any industry's operational process, once it becomes monotonous and rigid, will produce a similar experience of monotony. This feeling may not be obvious in the early stages of a trader's journey due to novelty, but it becomes increasingly strong as trading experience accumulates.

The forex trading industry is essentially a means of livelihood, no different from other industries. It lacks the idealized halo of excessive romanticization, nor is it as fraught with negative risks as some perceive. For forex traders, the core is to clearly define their trading goals and profit expectations, abandon the mentality of greedy speculation, and clearly define the boundaries of trading opportunities they can grasp, rather than blindly chasing every potential opportunity arising from market fluctuations. This avoids trading errors due to uncontrolled opportunity selection.

In the practical growth cycle of forex trading, the trader's development exhibits a clear cyclical iterative characteristic. The early growth stage often involves repeated cycles of "self-awareness improvement – market feedback correction." That is, when traders establish the belief that their trading system is feasible and their trading skills are outstanding based on periodic profits, they are easily subject to trading losses due to sudden market trends or unexpected market fluctuations, thus shattering their original understanding. Only through repeated cycles of refinement, continuously optimizing the trading system and correcting the operational mindset, can trading skills steadily improve, truly breaking through growth bottlenecks.

The core hallmark of a successful forex two-way trader lies in establishing their own practical trading system and standardized operating rules. This involves clearly identifying and identifying opportunities that align with their trading logic, while simultaneously possessing the mindset and ability to accept the potential risks behind those opportunities and the possibility of trading losses. This is also a key difference between novice and beginner traders.

In the field of forex two-way investment and trading, many novice investors often fall into a misconception: that as long as they solve the problem of accurate market prediction, they can turn the forex market into their personal ATM.

In reality, this view ignores the complexity and uncertainty of the forex market. For beginners, excessive focus on directional prediction not only limits their perspective but also hinders their progress in actual trading, leading to misunderstandings about the nature, methods, and profit models of trading.

Different traders employ different strategies to cope with the challenges of the forex market. Some traders, after experiencing setbacks for a period, are able to think about problems from a broader market perspective, thus overcoming difficulties and building a relatively advantageous trading system. However, most beginners are eliminated from market competition because they cannot break free from their reliance on directional predictions.

In fact, successful two-way forex trading is not entirely based on accurately predicting market fluctuations, but involves a balance between probability calculations and subjective judgment with objective reality. Many traders find it difficult to accept losses, mistaking a probability-based problem for a prediction one, which undoubtedly increases the difficulty of trading. Unless one can manipulate the market—which is obviously impossible—prediction alone cannot solve the challenges of trading.

For beginners, building a relatively advantageous trading system is the path to success. Filtering trading opportunities through such a system is more conducive to consistent profitability than simply focusing on directional predictions. It's important to note that trading opportunities are not obtained by studying high and low support and resistance levels, but rather emerge naturally through waiting and filtering.

For example, many beginners tend to chase highs and sell lows, buying currency pairs that are hitting new highs because they feel these currencies are "cheaper" than before and have greater profit potential. However, a more sensible approach is to patiently wait for currency pairs that are consolidating or fluctuating, and then act when they show signs of a breakout. This approach avoids unnecessary risk while capturing truly profitable opportunities. It aligns better with the operational logic of professional traders and helps achieve long-term, stable returns.

Limitations of Classic Technical Theories in Forex Two-Way Trading and Optimization Paths for Traders' Learning Mindsets.

In the forex two-way investment market, classic technical theories serve as an important reference for traders to analyze the market and judge trends. Their core function is to provide traders with an analytical framework and logical thinking that has been validated by the market over a long period, helping them to understand the underlying patterns of forex exchange rate fluctuations. However, this also places higher demands on traders' learning mindset; correct learning, cognition, and thinking patterns often determine whether a trader can translate theory into practical trading ability.

In the practice of two-way forex trading, the limitations of classical technical theories cannot be ignored. This is primarily reflected in the correlation between entry and exit rules and profit outcomes. Although various classical technical theories clearly define specific entry and exit conditions, providing traders with operational guidelines, these conditions do not directly translate into stable profits. The very rationality of these theories as a unified trading standard in the forex market is controversial. More importantly, over-reliance on such standardized theories can solidify traders' thinking and limit their ability to flexibly analyze market fluctuations. Furthermore, the applicability of these theories is particularly prominent. The forex market is essentially a zero-sum game, and various classical technical theories that have been around for centuries often exhibit uniform standardized characteristics, lacking specificity and flexibility. They are difficult to adapt to the different cognitive levels, trading habits, and risk tolerance of traders, and naturally cannot help each trader achieve personalized profit goals.

In forex trading, especially for beginners, traders are prone to various cognitive pitfalls. The most common is the excessive pursuit of profit. Many newcomers to the forex market focus solely on generating profits, neglecting the accumulation of trading skills and the refinement of their thinking patterns. Simultaneously, many novice traders overlook the importance of independent thinking, mistakenly equating trading learning with following a uniform, standardized process. They lack independent thought and fail to recognize that trading thinking and the learning process should be flexible and autonomous, and should not be overly constrained by standardized theories.

For forex trading beginners, the correct learning approach should balance autonomy and practicality. Freedom in trading learning is not about blindly exploring at will, but rather about basing oneself on one's own cognitive level, thinking habits, and risk tolerance. It involves actively studying market dynamics, summarizing practical experience, and gradually developing a trading logic and operational methods suitable for oneself, with the actual fluctuations of the forex market as the core. In combining theoretical learning with practical application, it's crucial to adhere to the core principle of results-oriented thinking. After all, results are the sole criterion for evaluating the effectiveness of technical theories. If the learned theory is disconnected from market reality and fails to generate positive profits, it's better to abandon such ineffective learning. In reality, many traders have experienced a continuous decline in trading results due to blindly learning theories unsuitable for them. Furthermore, traders must avoid the pitfall of conformity. Many traders blindly follow the trend of using a particular technical theory simply because most people do, ignoring their own suitability and market differences, ultimately failing to achieve stable profits.

In forex trading, conformity is prevalent. Many traders tend to blindly follow the operations of the majority or the strategies advocated by so-called "trading gurus," lacking independent judgment and critical thinking, mistakenly believing that widely adopted methods must be effective.

However, actual trading results often contradict expectations. The root cause lies in a misunderstanding of technical indicators: any technical indicator is essentially a statistical summary of historical price behavior, and its effectiveness is usually limited to specific market environments or timeframes, not universally applicable to all market conditions. Over-reliance on a single indicator not only restricts a trader's perspective but can also lead to misjudgments by ignoring dynamic market changes.

Therefore, traders should regularly review their trading records, objectively examining whether the support and resistance levels they believe in truly provided an advantage in actual entry and exit decisions. From a probabilistic perspective, in forex trading, without effective access to key information and forward-looking judgment, the win rate will essentially approach 50%—this is not accidental but a natural consequence of market randomness and information asymmetry. In this context, a shift in trading mindset is urgently needed: one should not fall into the trap of "replacing old techniques with more advanced ones," because simple technical iteration cannot overcome the inherent limitations of technical analysis itself. The real breakthrough lies in stepping outside the technical realm and reconstructing trading logic from the dimensions of probability distribution, expected value, and risk control.

When traders truly accept the premise that trading is essentially a probabilistic game, their focus should shift to risk management and optimizing the risk-reward ratio. Furthermore, their understanding of trading tools needs to be deepened: tools such as candlestick charts and moving averages should not be seen merely as sources of predictive signals, but rather returned to their original purpose—as tools for objectively measuring market sentiment, supply and demand, and price structure, serving systematic trading decisions based on probability and discipline.

In the forex two-way investment market, there are significant differences between traders at different levels (novice and experienced traders). These differences are particularly evident in their perception and attitude towards luck. Traders will experience periods of favorable trading conditions in actual trading, and behind this so-called "luck" lies, in essence, the precise matching of trading rules, trading systems, and market conditions.

In forex trading, novice and experienced traders have drastically different attitudes towards luck. Novice traders often deliberately avoid mentioning that their profits are due to luck. When disagreements arise with other traders, they are quick to argue about the merits of their own trading views and techniques, attempting to prove the correctness of their trading logic. Experienced traders, on the other hand, are more rational. They don't blindly believe their trading techniques or philosophies are superior to others. They objectively acknowledge that luck may have played a role in their high returns at a certain stage, and clearly recognize that such high returns are unsustainable. They avoid falling into the trap of arrogance or blindly replicating past trades.

In the actual operation of two-way forex trading, traders often encounter periods of exceptionally smooth trading, manifested as immediate profits upon opening positions and a near 100% win rate when trading trending trends. However, it's crucial to understand that such extreme success is merely a temporary phenomenon. In the long run, influenced by the uncertainties of forex market exchange rate fluctuations, macroeconomic factors, geopolitical factors, and other variables, the win rate cannot be sustained at this level. Ultimately, long-term trading results will come down to the trader's own trading skills and the stability of their trading system.

Further analysis of the essence of "luck" in two-way forex trading reveals that, on the surface, a trader's profits may seem to involve luck. However, the core reason is that their trading rules and systems happen to perfectly align with the current market conditions. There is a close intrinsic connection between luck and trading rules, primarily manifested in two dimensions: from the trader's perspective, each trader has their own established trading rules, clearly defining the types of market conditions they want to capture, entry and exit signals, and profit targets, forming a trading logic that conforms to their own trading habits and risk tolerance. From the market perspective, when the forex market moves in the direction the trader has predicted, precisely matching the tradable conditions defined in their trading rules, the market will reward the trader accordingly. This seemingly "luck" result is actually the inevitable product of the precise matching between the trading system and market conditions, and also the result of the trader's long-term adherence to their own trading rules and continuous optimization of the trading system.

In forex trading, expert growth often stems from profound insights, and the path to mastery is not linear but a spiraling ascent.

Most traders, from market novices to consistently profitable professionals, must undergo repeated trials of profit and loss, constantly peeling back the layers of appearances to grasp the essence, thereby truly understanding the market's operating logic and the core principles of trading.

As their cognitive level improves, they develop entirely new understandings of trading at different stages, even completely overturning their previous strategies and beliefs. This iterative cognitive development is not instantaneous but gradually completed through the interaction of market feedback and self-reflection.

Many seasoned traders, when reflecting on their key breakthroughs, often mention realizing forex trading is not merely about price movements, but more importantly, about seizing trading opportunities—for example, identifying currency pairs in a low-price range after a continuous decline or a high-price range after a continuous rise, thus making informed long/short decisions in high-probability scenarios.

This cognitive leap from "looking at prices" to "judging timing" is often a crucial turning point in achieving stable profits, marking a fundamental shift in trading thinking from mechanical reactions to strategic judgment.

In the forex two-way investment trading market, a book that focuses entirely on profits and exaggerates their effects cannot actually be considered essential professional investment reading for qualified forex traders.

In forex two-way investment trading practice, traders need a clear understanding of the criteria for judging good forex trading books, the differences in advantages and disadvantages of various trading methods, and, more importantly, be wary of common misconceptions found in forex trading books.

One of the most typical pitfalls is the one-sided promotion of profits. Many forex trading books simply teach so-called "profit-making techniques," and the case studies in these books deliberately select market conditions that perfectly demonstrate profit-making effects, while ignoring the randomness and uncertainty of the forex market, which is influenced by multiple factors such as macroeconomics, geopolitics, and exchange rate fluctuations. Traders who blindly follow the methods in these books often find themselves in a situation where profits fall short of expectations. Another misconception is the deliberate concealment of the side effects of trading methods. These books only present the profitable scenarios of the trading methods in a one-sided way, without clearly informing traders that any forex trading theory or practical method has corresponding limitations and side effects. This easily leads readers to fall into the cognitive trap of "what you learn is the whole truth," and consequently, they lack the ability to predict risks in actual trading.

In forex trading, promotional materials for short-term trading are often misleading. Many books and training courses on short-term trading overemphasize the high win rate of their methods while deliberately ignoring the crucial profit/loss ratio. This approach easily leads novice forex traders to mistakenly believe that "win rate is king," neglecting the decisive impact of the profit/loss ratio on overall trading returns. Ultimately, they waste significant time, energy, and trading capital in blindly pursuing high win rates.

Compared to short-term trading, long-term forex trading has distinct characteristics. Its core feature is the coexistence of a high profit/loss ratio and a low win rate. Many books on long-term trading focus only on depicting the ease and profits of successful traders, ignoring the fact that forex trading is essentially a game where "a few profit, most lose"—a classic "loser's game." If readers fail to clearly understand the side effects of long-term trading methods, they cannot establish reasonable risk expectations and maintain a stable trading mindset in volatile markets.

Furthermore, in forex trading, there is a close relationship between trading psychology and trading methods. Many traders attribute poor trading psychology to their own mindset, but this is not the case. Some psychological problems stem from inappropriate trading method selection. If traders can fully anticipate the worst-case scenario before choosing a trading method and prepare accordingly, their trading psychology and execution will significantly improve. Even experienced traders can experience emotional fluctuations and decision-making errors if they cannot clearly predict the extent of loss when opening a position.

It is important to clarify that there are no absolutely good or bad trading methods in forex trading, nor is there a single method suitable for all types of traders. Therefore, the key to choosing a trading method is not to pursue the "optimal method," but rather to comprehensively and objectively understand the advantages and disadvantages of various methods, identify their potential side effects, and, based on their own risk tolerance, trading habits, and capital size, determine whether the side effects of the method are within their acceptable range. Only then can they choose the most suitable trading method to achieve long-term, stable trading returns.

In forex trading, many traders encounter the dilemma of "adding to winning positions only to lose everything in one go." The root cause often lies in the inappropriate timing and price level of adding to positions.

Many traders, after seeing others profit by adding to positions, attempt to imitate this strategy, only to find themselves not only failing to replicate success but also eroding or even completely giving back their original profits. This repeated frustration can easily lead to psychological instability, causing traders to doubt the strategy itself and fall into either the extremes of being afraid to add to positions or blindly adding to them.

In essence, the forex market is highly random and unpredictable. Each trade—whether the initial position or subsequent additions—is essentially an independent event, with no necessary causal relationship between them. However, this does not mean that adding to positions lacks a logical basis. From a probabilistic perspective, rationally adding to a position based on existing unrealized profits can theoretically improve the overall win rate of the position. From a cost perspective, if we acknowledge that the market spends most of its time in a directionless oscillation, then adding to positions during pullbacks or rebounds at more cost-effective points helps optimize the average cost of holding the position. Conversely, adding to positions at temporary highs or lows can significantly raise or lower the overall cost basis, dragging a trade that could have broken even or even made a small profit into a larger loss.

Therefore, adding to a position is not simply about increasing position size, but a systematic decision that requires consideration of market structure, risk control, and psychological discipline. The real challenge for traders often lies not in technical judgment, but in overcoming greed and fear when facing unrealized profits, and executing a proven adding-to-position strategy with rational and consistent logic.

In the forex market, most traders generally suffer from a psychological cognitive bias, subjectively perceiving that making a profit is significantly more difficult than incurring a loss.

This cognitive bias manifests in actual trading as follows: many traders intuitively feel that earning a profit target of $200 often requires significant time and effort and is difficult to achieve, while losing $200 often occurs in a short period. In fact, many traders who initially set a profit target of only $200 end up losing far more than that amount.

The core cause of this phenomenon lies in the profound impact of the anchoring effect in forex trading. Most forex traders use a $200 profit target as their core psychological anchor. This anchor continuously interferes with their psychological activities and decision-making during trading, leading to erratic trading behavior. When account profits approach the preset $200 target, traders are prone to excessive psychological pressure, choosing to close positions prematurely out of fear of profit retracement, ultimately missing out on potential future profits. Conversely, when profits fall short of the $200 target, if the account incurs losses, traders, unwilling to accept the shortfall and eager to make up for the gap, choose to hold onto losing positions, ignoring market trend changes and risk management, ultimately causing losses to continue to expand, far exceeding the initial $200 expectation. Furthermore, accounts with daily profit as their core trading goal, while achieving small profits on most trading days, often experience relatively large losses on losing days. Moreover, some profits are not based on sound trading logic but rather on irrational position-holding, making it difficult to achieve stable profitability in the long run.

Besides the anchoring effect of profit targets, the cost basis is also a crucial anchor point for forex traders' exit decisions, especially when the account is in a losing position. This anchoring effect is even more pronounced then. Many novice traders tend to use "breaking even without loss" as their core exit criterion, rather than relying on professional tools such as candlestick charts and technical indicators to identify market breakout points and set reasonable stop-loss levels. This irrational exit decision can easily lead to traders getting deeply trapped in trending markets, with losses continuously escalating.

To mitigate the negative impact of the anchoring effect in forex two-way trading, traders can alleviate and avoid it through scientific methods. In daily life, they should focus on horizontal comparisons, rationally assess their own trading skills and profitability, and reduce psychological imbalance caused by excessive vertical self-comparison. In practical trading, the core is to build a sound trend-following trading system and scientific trading logic, resolutely blocking unverified rumors and market noise. Utilizing the positive contradictory information within the trading system can offset the interference from market price fluctuations and divergent bullish/bearish news, thereby shifting excessive focus from anchor points such as profit targets and holding costs, achieving rational trading and stable profits.

In the field of forex two-way investment trading, forex investment is essentially a loser's game.

For novice investors, with $200,000 in forex trading, a daily loss of more than $300 can cause anxiety and sleepless nights. However, for experienced traders, a daily loss of only $300 might be considered lucky. Therefore, before starting forex trading, it's crucial to ensure your trading capital is sufficient to withstand losses; it shouldn't be urgently needed funds or obtained through debt. Even if you are financially capable of accepting losses, if you psychologically feel unable to bear them, it indicates your risk awareness and psychological tolerance are unsuitable for trading, and you should consider exiting the market.

Forex trading is essentially a pure risk management and zero-sum game; there are no intrinsically valuable chips. A trade can occur simply because there is a difference of opinion. The outcome is inevitably one side profits while the other loses, and market trends affect forex investors both in a trending and counter-trend manner. For forex investors, losses are an unavoidable norm; regardless of whether your operations are correct or not, small losses and large gains are the way to survive. Reflecting on losses becomes an important learning opportunity, as losses are an unavoidable part of trading, and learning how to handle losses is a lesson every trader must master.

Continuous participation in forex trading requires not only focusing on profitability but also considering how to handle losses and your personal psychological reactions. When market conditions are favorable, most traders can profit; however, when market conditions are unfavorable, it tests who can withstand the pressure. For forex investors, the relationship between learning and loss is crucial. If losing a substantial amount of capital, even just $300, causes sleepless nights, it's difficult to seriously learn trading skills with that mindset. The correct approach is to accept that losses are an integral part of the learning process; striving to learn without losing, or even to profit, is unrealistic. If you cannot accept losses as part of learning, then you shouldn't be involved in the forex market.

In the field of two-way forex trading, most traders face the challenge of learning trading techniques effectively. Behind this phenomenon often lie several easily overlooked core factors.

In two-way forex trading, the uncertainty of trading outcomes is the primary contributing factor. Incorrect trading behavior does not necessarily lead to losses. Even if a trader uses irrational trading logic, unscientific operating methods, or even relies entirely on algorithmic trading, some of their trades may still be profitable. Such accidental profits can easily mislead a trader's judgment of their own trading system. Conversely, even if a trader follows scientific trading logic, adheres to rigorous trading principles, and executes correct trading operations, some of their trades may still result in losses, even leading to a series of losses. This situation severely challenges a trader's confidence in their own trading strategy, thereby affecting the stability of their trading mentality. Meanwhile, the misleading consequences of holding onto losing positions cannot be ignored. In actual trading, some trapped orders, if held long enough until the losses end, can often be recovered or even profitable. This accidental phenomenon makes it difficult for traders to clearly define the boundaries of right and wrong in their trading operations, especially for novice traders, who are prone to cognitive confusion and unable to establish correct trading judgment criteria.

Besides the uncertainty of trading results, common trading misconceptions among novice traders in forex two-way investment trading are also a significant reason for the increased learning difficulty. Novice traders are prone to serious doubts about stop-loss orders. Because the logic of not using stop-loss orders aligns more with the human tendency to gamble, many novices, in the early stages of building their own trading system, often question the importance of stop-loss orders, thus spending a lot of time researching unreasonable methods that avoid deep losses without stop-loss orders. This undoubtedly wastes their golden learning period in the early stages of their career and delays the establishment and improvement of their trading system. In terms of trading expectations, novice traders often fall into cognitive biases, frequently asking how long it will take to achieve consistent profitability after entering the market. They are eager to quickly reach their profit goals in the forex market, and this get-rich-quick mentality leads them to ignore the gradual nature of trading learning, making it difficult to calmly hone their trading skills and accumulate experience. In terms of trading mindset, novice traders face greater challenges in shifting their approach. If they can move beyond the limitations of purely technical analysis in their first year or two of learning, establishing a scientific probabilistic trading mindset and recognizing that the essence of forex trading profitability lies in the accumulation of long-term probabilistic advantages, rather than the outcome of a single trade, their trading understanding will far surpass that of other novices entering the market at the same time.

Furthermore, novice traders' misunderstandings about "trading enlightenment" in two-way forex investment further increase the difficulty of learning to trade. Many novice traders mystify the concepts of trading enlightenment and "simplicity is the ultimate sophistication," viewing them as unfathomable and unattainable realms. They overlook the core essence of trading enlightenment—it's not about mastering some mysterious trading technique, but rather about gradually confirming and firmly implementing correct trading logic and methods after sufficient trading practice and accumulating enough profit and loss experience, moving beyond initial doubt and trial and error. Essentially, it's a process of breaking through cognitive biases and returning to the essence of trading. Its core lies in the accumulation and summarization of long-term practice, not in sudden enlightenment.

To address the aforementioned issues, novice forex traders need to grasp two core points during their learning process: First, develop a long-term trading plan. Forex trading is a gradual and continuous learning process, far more challenging than other investment fields. Before entering the forex market, be prepared for long-term commitment, ensuring you remain in the market to experience market fluctuations and accumulate trading experience. This real-world market experience is irreplaceable by simulated trading and forms the foundation for building a mature trading system. Second, avoid blindly over-leveraging. Do not harbor the illusion that "repeatedly over-leveraging will consistently yield high returns." While over-leveraging may bring high single profits, it also amplifies trading risks, easily leading to significant losses. This violates the core principle of forex trading: "steady profits and long-term survival." Reasonable position control and adherence to risk management are crucial for long-term success in the forex market.

In forex trading, the trader's mental stability is paramount, yet the human element is precisely the weakest link in the entire trading system.

There is a mutually reinforcing relationship between trading and emotions: it's difficult to discern whether emotions amplify trading behavior or whether trading results, in turn, exacerbate emotional fluctuations.

Extensive practice shows that emotions have a significant impact on trading results—the more emotional one is, the worse their trading performance tends to be, and the more likely they are to find themselves struggling passively in the market; conversely, when traders are focused and natural, they are more likely to make rational decisions and achieve good results. Therefore, the core key to achieving stable trading lies in emotional stability. The final and most crucial step in improving the consistency and reliability of trading is to establish and maintain good emotional control.

From a technical perspective, the differences between mainstream trading methods are not significant in the initial stages. Basic technical indicators such as highs, lows, golden crosses, and death crosses all have clear objective definitions, and the differences produced by different traders using the same strategy are usually small. Even with minor parameter adjustments, the overall performance largely converges after extending the time frame or increasing the sample size.

What truly causes the divergence in trading results is not the technology itself, but the highly subjective factor of the trader's emotions. Emotions are easily influenced by external factors, such as account profit/loss status and comparisons with other traders, which can subtly affect judgment.

More importantly, emotional stability directly determines the quality of trade execution: even if an ideal entry point is identified, emotional imbalance leading to lax discipline and distorted operations can still result in missed profit opportunities or even a reversal of profit into loss. Therefore, in forex trading, technical skills are the skeleton, while emotional management is the flesh and blood that determines success or failure.

In the two-way forex market, most investors generally lack risk awareness and mindset commensurate with their trading risk tolerance, which is a significant contributing factor to their trading failures.

For forex trading novices, after the initial one to four-month adaptation period, they often enter a plateau in trading profits and losses, namely a period of stable losses. This phenomenon is particularly common among retail investors.

As the main participants in the foreign exchange market, retail investors are essentially passive followers of market trends. However, market fluctuations are fundamentally a process of risk transfer; only when effective risk transfer is completed can a clear market trend emerge. Retail investors frequently engage in trading behaviors that contradict the mainstream market trend. This is influenced by objective factors such as the interplay of bullish and bearish forces and the rhythm of market fluctuations, as well as subjective factors closely related to investors' own unbalanced trading psychology, such as greed and fear.

It's important to clarify that forex trading techniques are inherently subjective; as the saying goes, "a thousand people, a thousand waves; a thousand people, a thousand methods." There is no absolutely unified and universally applicable trading technique system. Win rate performance is significantly dependent on market conditions—a particular trading technique may demonstrate a high win rate in a specific market cycle, while performing poorly in another. The core factor is the inherent volatility characteristics and operational logic of the market itself. More importantly, it's crucial to understand the fundamental relationship between market conditions and technical analysis. Market conditions are the cause, and technical analysis is the effect. Technical analysis is always a summary and adaptation of existing market conditions, not an absolute basis for predicting future trends. Investors must abandon the misconception of prioritizing technical analysis and avoid falling into the trap of over-reliance on technical indicators while ignoring the true nature of market conditions.

Furthermore, in forex two-way trading, the core of trading is not simply proficiency in trading techniques, but rather building a robust trading system with a positive profit-loss ratio and a high win rate, coupled with a scientific money management strategy, and maintaining a stable and rational trading mindset. From a probabilistic perspective, even if an investor lacks solid trading skills, their occasional correct subjective judgment is merely a matter of probability and cannot form a sustainable profit model. Only by balancing a trading system, money management, and trading mindset can one achieve stable returns with controllable risk in long-term forex trading.

In the field of forex two-way investment trading, investors must fully recognize the potential risks of not being psychologically prepared for losses.

When trading forex, whether facing profits or losses, one must have the corresponding psychological preparation and resilience. Just as a mentor needs to be prepared for the challenge of repeated explanations of knowledge and overcome the so-called "curse of knowledge," forex traders should ensure that they have mentally prepared for all possible situations before entering the market.

Successful forex trading relies not only on technical analysis and money management strategies, but also on investors comprehensively assessing potential risks before each position and only trading at a level they can handle. Furthermore, maintaining a stable and healthy trading mindset is crucial. While a single instance of good mindset may not immediately demonstrate its importance, a single moment of mental imbalance can wipe out long-term efforts. Therefore, traders need to consistently hold themselves to high standards to maintain a sound trading mindset.

It's worth noting that the idea that avoiding greed alone can achieve consistent daily profits reflects a lack of understanding of forex trading risks. In reality, every profit comes with corresponding risk. This misconception hinders investors from pursuing greater profits and can lead to irrational "holding on" behavior when facing losses, indicating a lack of psychological preparedness to accept losses.

In short, before starting forex trading, the key is to thoroughly understand and manage risk. A clear risk management strategy should be established upon entry; otherwise, one should not enter the market lightly. This is not only the foundation of successful trading but also a vital measure to ensure capital safety.

In the forex two-way investment trading market, it is crucial for novice traders to receive guidance from experienced professionals during the initial learning phase.

This effectively shortens the learning cycle and reduces trial-and-error costs. In particular, the precise guidance from experienced traders helps beginners quickly clarify trading logic, thoroughly understand market patterns, and avoid falling into the cognitive trap of "half-understanding," achieving a rapid breakthrough in trading knowledge.

For forex two-way investment trading, the core value of leveraging others' experience lies in the efficient reuse of mature trading logic. Experienced traders, based on their own practical experience, can directly and clearly define practical techniques and judgment methods suitable for the current market environment and trading instruments. This helps beginners skip the stage of blind exploration, significantly improving their learning efficiency. The cognitive improvement brought about by this experience-based guidance is often difficult for beginners to achieve quickly through self-study, enabling them to achieve a thorough understanding of the core trading logic in a short period.

It is particularly important to note that forex trading is inherently highly volatile and risky. The loss rate and attrition rate among market traders remain high. Newcomers who rely solely on self-exploration will not only waste a significant amount of time but are also prone to severe losses due to misjudging market trends and applying inappropriate trading strategies. If their capital reserves are insufficient, they are easily swayed by continuous losses, making it difficult to maintain a long-term presence in the market. The core reason for the industry's high attrition rate and low win rate is that many newcomers, before mastering mature trading skills and developing a stable trading system, are forced to exit the trading market due to substantial losses from prolonged trial and error, depletion of their capital, or psychological imbalance.

Therefore, novice forex traders need to focus on several key points in the initial trading stage. The most crucial is to seek guidance from reliable, experienced traders to mitigate common risks in the introductory phase. If guidance is unavailable or you prefer not to rely on others, strictly control your initial investment, avoiding investing all your capital. Given the high volatility of the forex market, smaller initial investments reduce the risk of failure and facilitate a smoother market adaptation. Simultaneously, beginners should prioritize loss control. Before identifying the root causes of losses and mastering effective risk management methods, minimize losses, slow down the trading pace, and participate in live trading with small amounts of capital to gradually accumulate market awareness and practical experience. Furthermore, beginners must avoid the misconception of being "eager for quick results." The core logic and market rules of forex trading require long-term live trading experience to grasp accurately. Blindly pursuing stable profits in the short term can easily lead to trading pitfalls, increasing the risk of losses and negatively impacting long-term trading mindset.

In forex trading, to truly succeed, traders need more than just technical analysis tools; they need a deep understanding of the psychology and behavioral logic of market participants.

Trading, on the surface, is about interacting with prices and charts, but in essence, it's a game of strategy against others—every trade reflects the clash of expectations, judgments, and strategies among different market participants. Therefore, successful traders must learn to understand others' thoughts, discern group sentiment, and form independent judgments based on this understanding. Simply relying on readily available technical indicators often fails to provide a sustained advantage because technical analysis is merely a summary of historical price behavior; its effectiveness rests on the assumption that "history repeats itself," but it cannot explain the deeper motivations behind price movements.

Many traders often view trading as a solitary journey, but this "solitude" stems more from individual perception than from market reality. The market itself is always interactive: even if you don't actively study others, other participants are constantly analyzing your behavioral patterns. Especially in the modern foreign exchange market, dominated by high-frequency trading, algorithms, and institutional investors, the competition among various types of capital is particularly fierce. Large funds vie for liquidity and pricing power, while smaller funds attempt to seize opportunities in the gaps. Furthermore, a natural asymmetry in information, resources, and strategies exists between large and small funds, creating a de facto "enemy" relationship.

Newcomers to the market often tend to focus their energy on optimizing technical indicators, attempting to improve their win rate by precisely fitting historical data. However, this approach easily falls into the trap of "overfitting," where the model performs exceptionally well on historical data but fails in live trading. The reason for this lies in ignoring the essence of trading techniques: they are not deterministic tools for predicting the future, but rather empirical descriptions of the probability distribution of market behavior. Truly effective trading ability lies not only in mastering techniques but also in understanding the market structure, participant motivations, and the logic of capital flows behind those techniques.

In the field of two-way forex trading, it is crucial to clearly define the core concepts, trading principles, and professional understanding of special market conditions involved in forex trading education.

The core principle of forex trading education lies in prioritizing experience over results. In the introductory stage of trading education, a trader's own practical experience is far more important than a single trading result. This is because initial experience forms the core foundation for accumulating trading expertise and refining trading logic, while short-term results are often influenced by market fluctuations and other accidental factors, lacking long-term reference value. Simultaneously, in the introductory stage, the process of validating trading logic and strategies is far more important than directly drawing conclusions. Only through repeated verification can one develop trading knowledge that aligns with their own abilities and adapts to the market, avoiding blindly applying ready-made conclusions and falling into trading pitfalls.

In the foreign exchange trading education market, the core principle for long-term development and success is to focus on the essence of the foreign exchange market and prioritize long-term survival. Only through long-term market participation, understanding market fluctuation patterns, and accumulating market experience can one gradually align their educational output with market demands, thereby forming a core competitive advantage in the education field.

Furthermore, in two-way foreign exchange trading, traders must adhere to clear trading principles. In the initial stages of trading, the most fundamental and core principle is to liquidate positions. By using small positions for trial and error, initial trading risks are reduced. Simultaneously, as market understanding deepens and trading knowledge accumulates, traders' trading decisions gradually align with market patterns and become more rational and correct.

In terms of market understanding, traders must resolutely avoid cognitive inflated egos and abandon subjective judgments based on assumptions. They must recognize that rational market understanding is the inevitable result of long-term market participation and continuous review and analysis. As traders experience more unexpected market conditions and unusual fluctuations, their respect for the market will gradually increase, enabling them to adhere to the core principle of "not substituting subjective opinions for market facts." They will consistently approach various forex market fluctuations with an objective and rational attitude, avoiding trading risks caused by cognitive biases.

In two-way forex trading, a trader's psychological evolution typically progresses from blind confidence to psychological collapse, then gradually towards conditional confidence, and finally to unconditional confidence—a complete process.

Initial blind confidence essentially stems from the cognitive blind spot of "not knowing what one doesn't know." Novices often mistakenly believe they have mastered market dynamics after only reviewing historical market data or completing a small number of simulated trades. Their confidence is not based on an understanding of the essence of trading, but rather driven by confirmation bias and the illusion of results. At this stage, traders haven't yet realized the psychological resilience, risk control capabilities, and systematic thinking necessary for real trading. Faced with the uncertainty and profit/loss outcomes of live trading, they struggle to maintain emotional stability and objective judgment.

Furthermore, overconfidence at this stage is often reinforced by horizontal comparisons with less experienced traders or minor success stories, masking deeper deficiencies in their trading systems, market understanding, and behavioral discipline.

More alarmingly, many traders at this stage mistakenly believe technical analysis is a "magic key" to predicting the market, confusing superficial signals with underlying logic and ignoring the limited role technical tools play in the overall trading system. What truly determines long-term performance is the development of comprehensive capabilities, including money management, risk control, market understanding, and psychological adjustment.

In the two-way forex market, the distinction between investment and speculation remains a core concern for traders.

While both are market operations, they differ fundamentally in their core logic, risk tolerance, and operational strategies. The core criterion for judging whether a trader's actions fall under the category of investment or speculation is singular: their tolerance for and response to trading drawdowns. This criterion is not subjective conjecture but a practical principle validated by the market over a long period. It applies not only to the qualitative analysis of overall trading behavior but also to the essential boundary distinguishing long-term investment from short-term trading.

From the core logic of forex investment, true investment does not pursue short-term market fluctuations for price difference gains. Instead, it is based on a deep analysis of long-term exchange rate trends and macroeconomic fundamentals (such as national interest rate policies, inflation levels, and trade balance) to earn stable returns from long-term trends. Based on this logic, investors maintain a very high tolerance for normal market drawdowns because they understand that the forex market is influenced by multiple factors, and short-term drawdowns are an inevitable phenomenon in the trend process, not a signal of trend reversal. On the contrary, they will regard such reasonable drawdowns as a positive signal.

Compared to speculators' panic selling and blind stop-loss orders during pullbacks, forex investors might even feel fortunate about reasonable pullbacks. The core reason is that pullbacks present a more cost-effective opportunity to add to positions. Within pre-defined investment logic and risk control limits, the exchange rate after a pullback will be closer to the investor's expected holding cost. Adding to positions at this point not only lowers the overall holding cost but also allows for higher returns when the long-term trend reverts. This is the most intuitive and core difference between forex investment and speculation in practical terms, and a key benchmark for verifying the essence of a trader's operations.

In two-way forex trading, traders commonly experience a degree of inferiority complex, which is perfectly normal.

Many successful forex traders have also fallen into this trap, not because of a lack of knowledge, common sense, experience, or skills—even if these elements are already highly proficient—but because of insufficient capital.

In the real market environment, even the most sophisticated trading skills are difficult to translate into sustainable returns, let alone achieve financial freedom, without a corresponding financial foundation. A weak account balance often limits a trader's operational space, risk tolerance, and compounding potential, making it difficult to execute strategies confidently even with sound judgment.

In fact, for the vast majority of traders, about 90% of feelings of inferiority stem from limited capital. Once a sufficiently robust capital base is established, psychological insecurity is significantly alleviated. Therefore, instead of indulging in various psychological adjustment techniques or vague theories of "overcoming inferiority" online, it's better to focus on practical paths to capital accumulation.

Only by solidifying the capital base can one truly overcome psychological difficulties and establish a sustained and confident trading style in the forex market.

In the two-way foreign exchange market, investors balancing their primary job with forex trading has become the mainstream participation model.

For ordinary families, compared to traditional investment categories, forex investment has a significant advantage in terms of entry barriers, requiring no excessive initial capital to participate in market trading.

We should view forex investment rationally, abandoning the preconceived notion of "fearing forex" and avoiding it blindly due to a one-sided understanding of its risks. In fact, while ordinary investors cannot directly invest in large, leading companies to share in their growth dividends, they can participate in global asset allocation through the convenient channel of forex trading, achieving flexible investment with small amounts of capital.

Furthermore, in the two-way forex trading scenario, if investors possess the corresponding market knowledge and operational conditions, they can actively explore this relatively niche investment area. Due to relatively low market participation and less competitive pressure, this area provides investors with a more relaxed trading environment and more flexible operational space, helping them better seize market opportunities.

In forex trading, traders should not fear failure. On the contrary, they should face failure with rationality and courage, because failure is an indispensable path to accumulating practical experience.

Only by personally experiencing losses and setbacks can traders deeply understand the logic of market operation, the essence of risk control, and the shortcomings of their own strategies, thereby continuously optimizing their trading system.

In this sense, failure is not the end, but a necessary stage on the road to success—each failure brings traders closer to the tipping point of profitability. This is why many experienced angel investors even prefer to support entrepreneurs or traders who have experienced failure.

The underlying logic is that those who have failed often cherish opportunities more, possess stronger risk awareness and execution capabilities, and have accumulated a wealth of valuable experience "approaching success" through practice; what they usually lack is no longer knowledge or methods, but simply the capital support needed to restart.

Therefore, in the foreign exchange market, failure should not be seen as shame, but rather as a valuable learning experience and a stepping stone to future success.

In the two-way foreign exchange market, the randomness of exchange rate fluctuations, the flexibility of switching between long and short positions, and the risks of leveraged trading mean that a trader's exceptional execution ability is not only their core competitive advantage but also a key factor determining the upper limit of their trading career.

In this highly specialized investment field, what truly differentiates traders is never talent or intelligence, but rather the exceptional execution ability to translate trading logic and strategic planning into concrete practice. Most forex traders' losses stem not from a lack of market understanding, but from being overwhelmed by the superior execution of their peers. Those traders who seem intelligent and accurately predict market trends, if lacking the ability to implement their strategies, will ultimately only miss profit opportunities while admiring their own success. Only exceptional execution can truly transform an advantage in understanding exchange rate trends, money management, and risk control into tangible trading results. This is the core value of execution in two-way forex trading.

In the context of two-way forex trading, the essence of a trader's ultimate execution is not simply "action," but rather the ability to initiate a trading process according to a pre-set strategy even when the market is sluggish, their own state is poor, or they even feel resistant to trading. It's crucial to understand that in forex trading, action itself activates the trading state, rather than passively acting only when emotions are running high or the market is clear. Furthermore, execution is also reflected in adhering to trading discipline and sticking to the established strategy even when the market is in a prolonged period of consolidation, short-term profits are not visible, or even small floating losses occur. This persistence is not passively supported by short-term profit incentives, but actively driven by a scientific trading structure and a comprehensive strategy system. It also requires maintaining rationality and steadily advancing each trading step when emotional fluctuations occur due to sharp market shifts, external market rumors cause interference, or one's own understanding of the trading strategy wavers; avoiding blindly adding or reducing positions, and refraining from arbitrarily changing the trading plan.

In the long-term competition of forex trading, exceptional execution has an irreplaceable advantage over talent. The true competition in the market is essentially a competition of compound interest over time. While exceptionally talented traders may achieve short-term profit bursts through a keen sense of market trends, this advantage is often unsustainable. Furthermore, such traders are prone to fleeting enthusiasm, anxiety due to market fluctuations, and frequent changes in trading direction and strategies. Forex traders with exceptional execution, however, do not need to rush to prove themselves. Once they choose a strategy that aligns with market principles and suits their trading style, they adhere to it consistently and execute it relentlessly, accumulating compound returns through standardized daily operations, gradually widening the gap between themselves and other traders.

For forex traders, the key to exceptional execution lies in building a robust trading execution system, rather than simply relying on willpower. The core reason for weak execution among most traders is the lack of systematic support. Highly effective traders often "outsource" execution to standardized trading systems. These systems can be designed following this logic: fix daily trading and review times; streamline and standardize core trading procedures, replacing on-the-spot decisions with fixed processes to reduce human error; and break down long-term trading goals into quantifiable daily steps, such as strictly adhering to stop-loss and take-profit ratios, reviewing a fixed number of trades daily, and controlling trading frequency. By reducing the difficulty of selection and lowering the execution threshold, each step is ensured to be executed efficiently.

In the forex two-way investment trading market, the core competitors are not a few exceptionally talented individuals, but rather those who are easily swayed by short-lived enthusiasm, overthink their trading strategies but underperform, are repeatedly dragged down by market fluctuations, and cannot adhere to trading discipline. As long as traders can achieve consistent and stable trading output through a systematic execution approach, maintain standardized operations with low emotional volatility, and do not pursue short-term windfalls, but simply steadily advance towards their predetermined goals, they can unknowingly join the ranks of the top 10% of traders in the market.

It is worth noting that although some currently believe that forex investment trading is in a phase of slow development, niche markets often mean lower competitive pressure and broader opportunities. In this era most favorable to ordinary people, the most valuable ability is the extreme execution of consistently applying correct trading strategies and scientific money management methods. The world will never fail those traders in forex two-way investment trading who are willing to adhere to discipline, cultivate their skills meticulously, and execute every trade to the highest standard.

In forex trading, a trader's "temperament" is not merely about outward demeanor, but a comprehensive reflection of their market awareness, psychological composure, and financial strength.

"Temperament" requires long-term cultivation, manifesting as a grasp of market rhythm, emotional control, and adherence to discipline; while "quality" relies on a solid economic foundation, especially the risk resistance and operational flexibility afforded by the size of the account. Only when these two are combined can a true professional temperament be formed forex traders.